The Iyo Bank, Ltd.

- Introduction Background: New Challenges in DX Promotion

- Introductory Solution: "Technology" and "accompaniment" realized by TDC Software

- Effect of introduction: Reduction of processing time by half and realization of hybrid sales

- Effect of introduction: Reduction of processing time by half and realization of hybrid sales

Iyo Bank "Easy Fire Insurance System" Case Study

Improving Customer Experience and Sales Efficiency with Digital Procedures Linked to Mortgage Loans

Iyo Bank has been promoting DX since the “2015 Mid-Term Management Plan” to create more time for employees to focus on high value-added operations. As part of this effort, the bank has introduced the “Easy Fire Insurance System,” which digitizes pre-contract procedures for fire insurance for mortgage loans. This eliminates the traditional paper-based procedures and reduces the burden on both customers and sales staff. This is an important example of digital implementation that embodies the bank’s “DHD Model” philosophy based on “Digital-Human-Digital” and improves the “ability to grow business.

Introduction Background: New Challenges in DX Promotion

Digitization of fire insurance procedures attached to mortgages was one of the issues to be addressed as part of DX promotion. While mortgage loans themselves were already available for online and smartphone applications, fire insurance procedures were still paper-based, requiring customers to visit a store or a bank employee.

Deputy Manager, Administrative Control Division

Satoshi Tanaka

Satoshi Tanaka of Iyo Bank recalls, “Mortgages were digital, but insurance was still on paper, creating a twist in the touch points. This “twist” led to administrative inefficiencies on the sales floor and an increased burden on customers. Furthermore, fire insurance policies are subject to renewal at maturity at regular intervals, and a large number of renewal cases were expected from FY2023 onward.

With conventional paper-based management, “calling” customers for renewal was limited to those who came to the store, and case management was inefficient. Iyo Bank’s urgent task was to solve these problems, reduce the burden of filling out forms for customers, reduce the number of omissions, and create a paperless system that would allow completion of procedures both in person and in person.

Introductory Solution: "Technology" and "accompaniment" realized by TDC Software

TDC Soft was selected as the development vendor for this system from among several candidates. The main reason Iyo Bank selected TDC Soft was that they “deeply understood our requirements and submitted a proposal that was closest to our image,” said Mr. Tanaka. Since the project was based on scratch development, we needed a partner that could truly meet Iyo Bank’s requirements, not simply the lowest price.

TDC Soft had worked with Iyo Bank in the past on the development of another system, and was familiar with existing operations and systems, which was another advantage.

In addition, TDC Soft’s extensive experience in developing systems for financial institutions and non-life insurance companies also proved to be a reliable partner. Mr. Tanaka highly appreciates TDC Soft’ s response, saying , “TDC Soft was able to digest exactly what we wanted to do and made a very specific proposal.

This project demonstrated TDC Soft’s wide-ranging technical capabilities and customer-oriented approach.

General Manager, Financial Systems, Financial Business Design Division

Ryo Shameshima

■ Design capabilities to handle complex business requirements

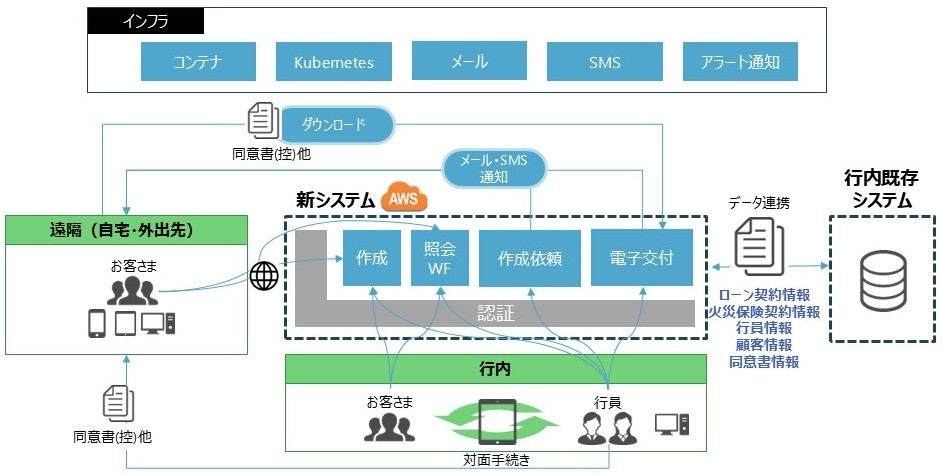

Ryo Samejima of TDC Software says, “We initially envisioned a relatively lightweight system, but in the process of finalizing the requirements, we discovered that there were quite a wide variety of business rules to be followed. To cope with this complex set of business rules, a highly scalable and maintainable “domain-driven design” approach was adopted for the back-end processing. In addition, for integration with existing systems, such as mortgage loan information, the bank employed batch processing, which has a proven track record in the bank, to reduce costs and ensure operational safety, thereby minimizing costs and maintenance bloat.

Modern architecture and high level of security

A modern architecture was adopted for application development. The design was based on a single-page application and RESTful web services, with consideration for CI/CD (Continuous Integration and Delivery), scalability in a cloud environment, and development efficiency. This created an infrastructure that can handle future maintainability and functional scalability.

The Iyo Bank IoT is a secure infrastructure that meets the unique requirements of a financial institution, and is designed with the expertise of TDC Soft’s in-house infrastructure experts, using IaC (Infrastructure as Code) templates to code the infrastructure. In addition to implementing and adhering to AWS best practices, Iyo Bank’s own checklist was used to reconcile the details. Specifically, client certificates, IP address restrictions, multi-factor authentication, and other authentication methods were combined to strengthen security during authentication according to the user and terminal.

Financial Business Design Division Financial Solutions Management Department

Financial Systems Innovation Department Takao Yamamoto

UI/UX with consideration for both employees and customers The

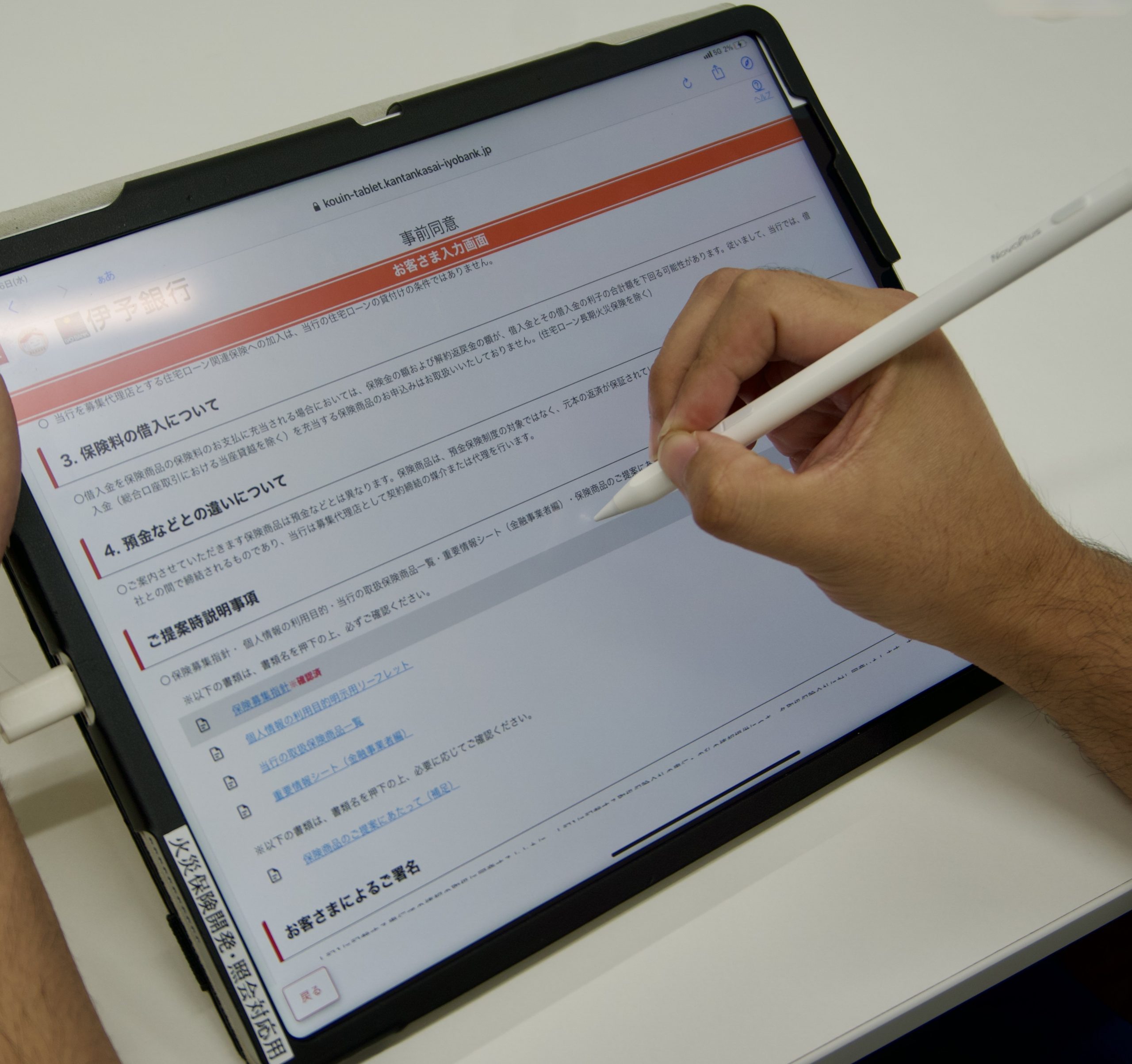

system allows both internal bank procedures and customer procedures to be completed within the same system, so “we sought a screen design that is easy to use for both employees and customers,” says Takao Yamamoto of TDC Software. As a result, the number and size of items on the screen, as well as the operation line, were carefully considered, and a unified design was adopted for the entire system. In particular, assuming that customers would be operating the system with smartphones and tablets, detailed design adjustments were made to ensure that the system would look good regardless of the type of device used.

Close Communication Across Distance

Because Iyo Bank and TDC Soft were located far from each other, maintaining smooth communication was an important issue for the project, and TDC Soft made intensive visits to Iyo Bank in the early stages of the project to gain a deep understanding of its workflow. In addition, TDC Software actively utilized a web conferencing system and chat rooms to communicate closely with Iyo Bank, sometimes late into the night, to discuss requirements on a daily basis .

Effect of introduction: Reduction of processing time by half and realization of hybrid sales

The introduction of the “Easy Fire Insurance System” has brought tangible benefits to Iyo Bank. The most noticeable change is the reduction in processing time for both customers and employees. Mr. Tanaka explains, “Procedures that used to take about two hours can now be completed in about one hour, cutting the time in half. The ability to perform procedures remotely has also had a significant effect on the bank, which has a wide range of branches, by significantly reducing travel time for both customers and employees.

Changes were also seen in the awareness and workflow of the sales staff. Before the introduction of the system, they only had the opportunity to recommend fire insurance to customers who came to the store, but now that the system is linked to mortgage loan information, “customers to be approached” are centralized in the system, and sales staff feel that “it has become easier to move around. The head office is also able to manage the progress of cases in a flow, and “we can see at a glance which cases are delayed or not moving, and we can provide guidance at an early stage,” Tanaka says, emphasizing the effect on management.

Furthermore, through the use of the system, Iyo Bank has established a “hybrid” sales style that allows customers to freely choose between face-to-face and non-face-to-face interaction according to their needs. This has greatly improved the customer experience, with cases that previously required multiple visits to the bank effectively requiring only one visit.

Future Prospects: As a partner to grow your business

Iyo Bank believes that system development “never ends” and recognizes the need for constant brushing up and functional expansion. In particular, the insurance business requires a flexible system that can respond to rapid changes in the external environment, such as changes in laws and regulations and transitions among insurance companies.

Iyo Bank believes that the digitalization of its operations has run its course and that it now has all the necessary tools, but it has entered a new phase of “growing its business” by training personnel to make good use of them. The bank plans to pursue new possibilities for DX throughout the bank, including the use of AI and RPA, not only through the systems division but also through the DX Strategy Department, which will be newly established in April 2024.

Iyo Bank expects the same “close communication” and “agile response” from its partner, TDC Soft, in future system maintenance and functional enhancements. TDC Soft intends to provide multifaceted support by leveraging its strengths, which include experts with deep knowledge of banking operations and specialists in technologies such as data utilization and AI/RPA. The company will continue to propose advanced technologies and solutions and build a strong partnership to support Iyo Bank’s further growth.